RBI projects GDP at 10.5%, maintains status quo on key rates

- EP News Service

- Feb 05, 2021

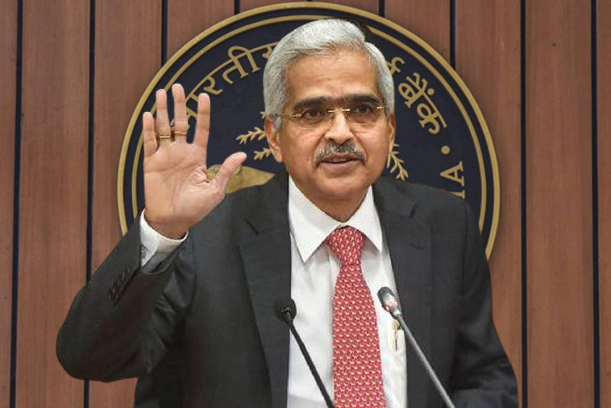

MUMBAI: Announcing the bi-monthly policy, the Reserve Bank of India (RBI) Governor Shaktikanta Das today said that it was continuing the accommodative stance, as it kept the key rates unchanged for fourth time in a row.

Das said that the Monetary Policy Committee (MPC)

which met on 3rd, 4th and 5th February, deliberated on current and evolving

macroeconomic and financial developments, both domestic and global and voted

unanimously to leave the policy repo rate unchanged at 4 per cent and reverse

repo at 3.35 per cent respectively.

Since the reverse repo rate will continue to earn 3.35

per cent for banks for their deposits kept with the RBI, banks are likely to

keep their interest rates on fixed deposit (FD) unchanged for the time being.

Similarly for borrowers like home loans on floating

basis which are linked with an external benchmark. i.e., repo rate, (called as

repo linked lending rate or RLLR by banks) they are not likely to see any

negative changes as of now.

Das said, "RBI has decided to continue with

accommodative stance as long as necessary, at least through the current

financial year and into the next year, to revive growth on a durable basis and

mitigate the impact of COVID-19."

RBI has projected the GDP growth rate for 2021-22 at

10.5% and said that the Indian economy is poised to move in only one direction

and that is upwards. Supporting the argument Das said that the Union Budget

2021-22 has provided a strong impetus for revival of sectors such as health,

infrastructure etc., and this will have a cascading multiplier effect going

forward, particularly in improving the investment climate and reinvigorating

domestic demand, income and employment.

RBI also gave a stable near term outlook for

inflation. As per Das, after breaching the upper tolerance threshold

continuously since June 2020, CPI inflation moved below 6 per cent in December

for the first time in the post-lockdown period. This he said was supported by favorable

factors like sharp fall in key vegetable prices.

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News