All that glitters is definitely gold right now

- Rommel Rodrigues

- Mar 30, 2023

Bullion metal prices touch a record high

MUMBAI: All that glitters is not gold they say, but the prices of the bullion metal are definitely glittering and soaring to the skies with newer heights. For the first time in history, Gold prices have surged to unprecedented levels, crossing the significant threshold of Rs 71,000 per 10 grams last Monday rising by more than Rs 1,500 in the intraday thereby breaking the Rs 70,000 mark for the first time. Bullion traders said the prices went soaring high due to increased geopolitical threats and active buying by central banks across the world due to which the demand went up very high leading to soaring prices.

In global markets, gold prices went past the $2,300/ounce mark recently and were nearing the $2,400 mark in mid-session in the New York market. And silver prices, after breaking above the $28/oz mark - a three-year high - were trading just below that mark. One ounce is equal to 31.1gm.

The surge in gold prices reflects a myriad of factors, including geopolitical tensions, economic uncertainties, and the global financial landscape. Several traders and experts also pointed out that activity for mining of gold has come down significantly which has led to speculations that the supply in the near future will become scarce. This remarkable milestone has left everyone pondering about the next level for this precious metal especially since the season of festivals and weddings is in the offing.

Although as gold continues its upward trajectory, investors are keenly looking at their trading strategies, the domestic jewellers' business has taken a big hit since people are not able to afford to buy jewellery in retail stores. Gold prices have risen by Rs 5,000 in 2024 alone, starting from Rs 65,500 on January 1. Jewellery sales have been subdued, with most purchases revolving around the recycling of old gold, according to retailers.

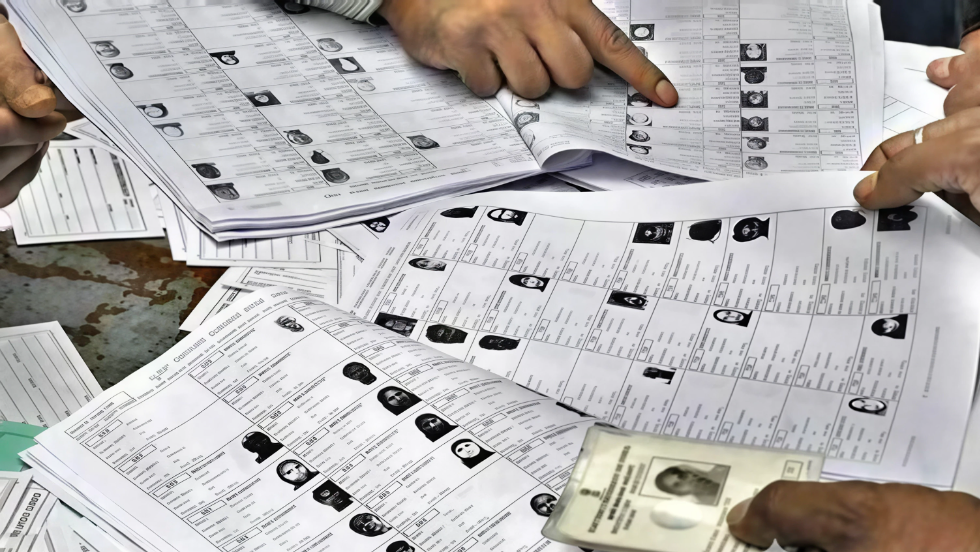

Some reports say that sales are down more than 50% from the year-ago period, and the growing prices of gold have resulted in a near-total stagnancy in jewellery demand in the first quarter in both rural and urban centres. The ensuing general election period extending to two months, which will see heightened scrutiny on the movement of gold and cash, will have a negative impact on retail business.

Reporter

Rommel is our Editor. He has close to three decades of experience in leading publishing houses including, Fortune India, Observer of Business & Politics, The New Indian Express etc.

View Reporter News