All that glitters is gold, prices hit new highs, but where is it heading?

- Rommel Rodrigues

- Apr 14, 2024

Gold prices are all time high and likely to remain bullish

MUMBAI: Gold has been considered a safe haven investment for ages even when there was no major asset class like currency, oil and definitely not stocks. For ages civilisations, kings and then elected governments around the world turned to this precious metal as a hedge against inflation, economic uncertainties, geopolitical tensions, and volatile markets.

In recent years especially in the near past, gold has experienced a remarkable ascent, capturing the attention of investors worldwide. Experts say the growing demand for gold from emerging economies, particularly China and India, coupled with limited supply growth is largely responsible for the meteoric rise in bullion prices in recent times. Additionally, the increasing adoption of gold-backed exchange-traded funds (ETFs) by institutional investors underscores gold's role as a portfolio diversifier and risk mitigation tool.

Retail traders, especially retail traders in India are hard hit due to this rise in prices as consumers are not coming to buy however the supply-demand dynamic has only supported higher prices in the medium to long term. Rasikh Bhai Chunnilal who owns three retail jewellery stores laments that footfalls are down by 30% this year as compared to last year and says that various schemes to lure customers are of little help. He said that many jewellers are now keeping more of 18-carat jewellery rather than 22-carat so that at least the display prices look affordable.

As we look ahead to the next three to seven years, the trajectory of gold remains a topic of keen interest and speculation and the question arises, where will gold prices settle by 2030? Will the contrasting view that equity as an asset class may outshine gold in the coming years hold true? We need to examine several key trends and indications which can provide valuable insight into the path of gold leading to 2030.

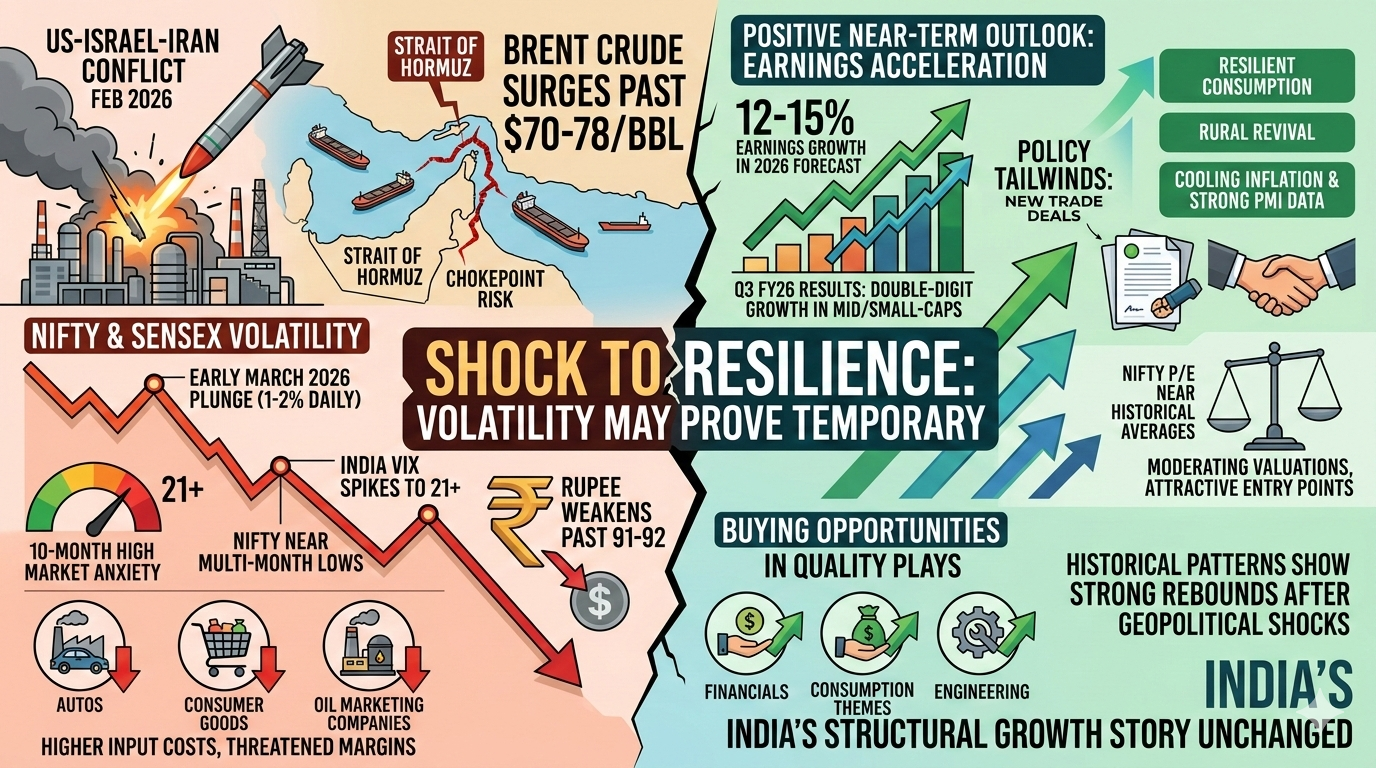

According to expert, several factors will contribute as major triggers shaping the outlook for gold in the coming years, including monetary policies of central banks of leading economies, inflationary expectations and without doubt geopolitical tensions. While rising inflation expectations or concerns about currency debasement can enhance gold's appeal as an inflation hedge and store of value, central bank policies, particularly regarding interest rates and quantitative easing measures, can impact the value of fiat currencies and influence investor sentiment towards gold

The geopolitical risks with escalated tensions between Israel and Palestine and other Middle Eastern countries and the ongoing war between Russia and Ukraine have disrupted trades and threaten geopolitical instability, if this continues it can heighten market volatility and increase demand for safe-haven assets like gold. These geopolitical tensions are creating pockets of economic downturns for countries in the region, Pakistan being one of the examples leading to currency devaluation which can drive investors towards safe-haven assets like gold, boosting demand and prices.

Lastly, market sentiment will play a very important role in determining which trajectory will gold prices move. Although market speculation and macroeconomic indicators can drive short-term fluctuations in gold prices, they will also influence its long-term trajectory.

Taking the above-discussed factors into account, it is conceivable that gold prices may continue on an upward trajectory over the next three to seven years, albeit with periods of volatility and fluctuations along the way. However, the magnitude of its appreciation will depend on the interplay of various macroeconomic and geopolitical developments. According to Vijay Shah trader in the bullion market, the prices are likely to remain bullish unless some external factor like a war-like situation erupts and it affects supply, alternately he says a lot will also depend on government taxation policies.

"Though it looks unlikely, in case, if government tinkers with taxes on bullion like say import duty, excise or GST then it will have a direct impact on the prices, like say any relaxation in duties will lead to fall in prices," he added.

When it comes to the debate between equity and gold, experts suggest that equity, as an asset class, may outshine gold in the coming years. Historical data indicates that equity investments have offered higher returns compared to gold over long periods. Equities are known for their potential to outperform inflation and generate wealth, albeit with higher risk and volatility.

However, gold has its merits. It acts as a buffer against uncertainty and can enhance portfolio diversity. It’s a more predictable asset over the long term, though it may not offer the same growth potential as equities. Investors with a higher risk appetite might lean towards equities, while those seeking stability may prefer the relative safety of gold.

Reporter

Rommel is our Editor. He has close to three decades of experience in leading publishing houses including, Fortune India, Observer of Business & Politics, The New Indian Express etc.

View Reporter News