The balancing act of Indian banks: Managing credit and deposit growth amid shifting trends

- EP News Service

- Sep 16, 2024

India's banks are facing a deposit shortage, causing concern among bankers

MUMBAI: The credit-deposit ratio (CDR) or loan-to-deposit ratio (LDR) has emerged as a critical measure in assessing the financial health of Indian banks. It reflects the percentage of deposits banks utilize for lending, thereby gauging their liquidity and credit extension efficiency. Historically, Indian banks have maintained a CDR of around 70-75%, which is considered ideal for balancing risk and ensuring liquidity. However, a high LDR may indicate that banks are over-leveraged, relying excessively on borrowing to cover lending, potentially leading to liquidity crises. Conversely, a low LDR suggests underutilization of deposits.

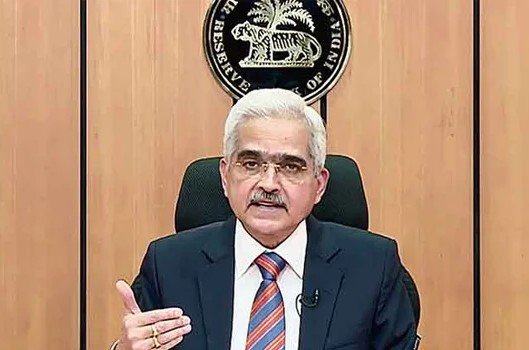

Recent fluctuations in the CDR and LDR have raised alarms among stakeholders about potential economic and financial stability risks. For instance, HDFC Bank's sharp rise in LDR to 110.5% after its merger with HDFC Ltd in early 2024 resulted in a stock market dip, highlighting the sensitivity of investors to such changes. The Reserve Bank of India (RBI) has expressed concerns over the widening gap between deposit growth and credit expansion, warning that continued disparity could lead to liquidity issues. As of July 2024, credit growth outpaced deposit growth by 3-4 percentage points, with loans increasing 13.7% year-on-year while deposits grew by just 10.6%. RBI Governor Shaktikanta Das and Finance Minister Nirmala Sitharaman have urged banks to address this gap, emphasizing the need to boost deposits to avoid long-term liquidity risks.

The challenge is compounded by a shift in investor behavior, with more individuals parking their funds in mutual funds and direct equities rather than traditional bank deposits. As of August 2024, India's mutual fund industry had reached a record Rs 66.7 lakh crore in assets under management (AUM), with rising inflows through Systematic Investment Plans (SIPs). This trend reflects a broader movement among younger generations towards more lucrative investment options, further straining banks' deposit growth.

Despite concerns, banking experts suggest that the situation is manageable for now. Several banks, including State Bank of India (SBI) and HDFC Bank, have taken measures to address the deposit-credit growth mismatch. While some banks have launched special retail deposit schemes, most have refrained from engaging in aggressive interest rate competition to attract deposits. Instead, banks are focusing on improving service quality and customer engagement to retain and grow their deposit base.

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News