How Rolta's creditors were stonewalled against insolvency proceedings

- Rommel Rodrigues

- May 27, 2021

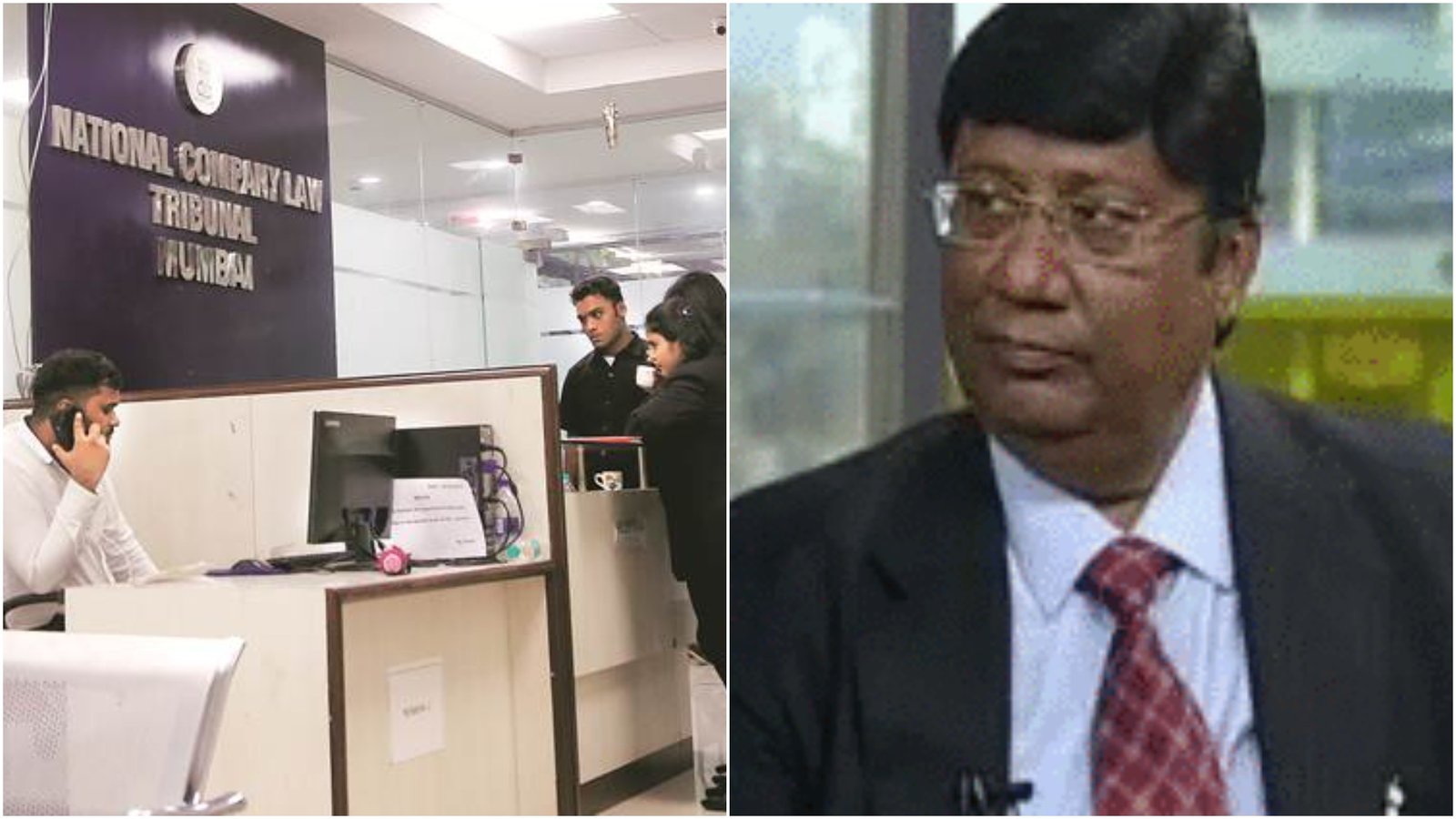

(Left) Rolta India's founder & managing director, Kamal K Singh

MUMBAI: Information technology company Rolta India Ltd (RIL)

now faces insolvency proceedings along with two of its fully owned subsidiaries

Rolta Bi & Big Data Analytics P Ltd (RBBDA) and Rolta Defence Technology

Systems P Ltd (RDTS) in case of unpaid dues of a former employee which includes

wages, perks and statuary payments

like TDS, EPF, gratuity etc.

The National Company Law Tribunal’s (NCLT) Mumbai ordered the

insolvency proceedings against RIL on 13 May, and appointed interim resolution

professional (IRP) Vandana Garg to initiate the insolvency resolution process,

who has now through a public notice on 25 May, has called on creditors of the

three companies to submit their claims within 15 days (by June 9, 2021).

The first step the IRP would be doing is superseding the

present management led by founder, chairman and managing director, Kamal K

Singh and taking charge of the operations, post which she will have to set the

ball rolling as the process of insolvency resolution which needs to be completed within

180 days.

The initial job of Garg as the IRP would be to form a committee

of creditors (COC), post which the appointment of the administrator will be done, following which a team

of professionals who can manage the business and affairs of the company will

have to appointed, COC will then try to determine a fair value for the company,

call for bids if anyone is interested in whatever is left and try to approve a resolution

plan.

The good thing is the creditors of the company which include

bond-holders with an outstanding due of Rs 3,762 crore and domestic PSU banks like Union Bank of India, Bank of India, Bank of Baroda,

Central Bank of India and Syndicate Bank with dues of Rs 4,308.27 crore in debt (As

on end March 2020), former employees who have not been paid wages, suppliers,

contractors and others will get to present their claims and hope to receive their dues in whatever package is approved in the final insolvency resolution plan.

The flip side however is, this is not the first time RIL

faces insolvency proceedings, in the past too, it has been dragged to the insolvency

court, however, it has managed to stonewall all such attempts.

RIL which was already into geospatially powered software

and geographic information system (GIS) for capturing and analysing data

related to positions on the earth's surface entered the defence business in a

big way post the Kargil war in 1999.

The defence administration of the country under the

erstwhile Congress-led UPA government was considering investing big time into

technology for the wings of the armed forces.

Considering it was a niche area RIL entered the GIS and

geospatial services in a big way and created a separate business division for

defence and went under a recruitment spree hiring retired colonels and

brigadiers and other consultants.

The company had formed a consortium with Bharat Electronics

Ltd (BEL) a Navratna PSU as a development agency for the ambitious defence

project of the battlefield management system (BMS) which was to be worth more

than Rs 50,000 crore and was assured that it was the top contender.

Envisaging huge returns from the defence business, RIL

started investing heavily by borrowing, first from the bond market through its international

subsidiaries then from banks and domestic institutions. However with the change

of regime, the defence project was junked, taking with it the company's humongous

growth targets that it had built up over the years.

With a slowing enterprise business and sunken investments in

the defence project RIL tried to capitalise on some of its core software

products and proprietary IP businesses by trying to sell them out. But it could

not and began defaulting on interest payments on loans, principal and

interests.

It had already defaulted in dollar term bonds interest

payment in 2016 and defaulting in paying interest and principal, most of its

borrowings from banks turned NPAs.

In the balance sheet as of end March 2020, the company had a

borrowing of Rs 4308 crore, which included Rs 1,456 crores from Union Bank of

India (UBI), Rs 1045 crores from Central Bank of India, Rs 809 crores from Bank

of India, Rs 635 crores from Bank of Baroda and Rs 363 crores from Syndicate

Bank.

It has an outstanding of over Rs 3,800 crore against Senior

Notes (Bonds) which it had issued in 2013 and 2014 at 10.75 % interest. The

interest keeps piling up.

In September of 2018, UBI the largest lender filed insolvency plea against RIL, however, it got out of bankruptcy as the case was dismissed by the NCLT in May 2019.

The company took a reprieve from the Supreme Court, which had

declared a February 12, 2018, dated circular of the Reserve Bank of India (under

which UBI had approached the tribunal) as ultra vires meaning it now beyond

the legal power or authority of NCLT.

The said RBI circular which classified an NPA of over Rs

2000 crore to be referred to NCLT after 6 months was struck down by the apex court on April 2,

2019 on a plea by a clutch of power producers, textile and sugar manufacturers

and the shipping industry in the apex court. RIL was able to ride on this

judgement to gets UBI’s insolvency proceedings stalled.

In November 2019, NCLT admitted the plea of Value Partner

Greater China High Yield Income Fund and Pinpoint Multi-Strategy Fund both

based in the tax haven the Cayman Islands, who claimed a default of around Rs 1,060

crore and ordered insolvency proceedings against RIL, an IRP from consultancy

firm E&Y was also appointed.

RIL, the parent company of Rolta LLC and Rolta Americas LLC,

had given a corporate guarantee for these step-down firm, who was the principal

borrowers. The creditors including former employees were once again relieved

that they could now file their claims, and it looked very plausible, however

this was not to be.

Almost immediately after the NCLT order was pronounced, in

his personal capacity, Kamal K Singh, the chairman & managing director of

RIL petitioned the Bombay High Court on a very peculiar technical ground that

the NCLT did not pronounce the judgement against RIL in an open court.

The matter was heard expeditiously and within days in

November 2019, the High Court in a landmark judgement ordered setting aside

NCLT's insolvency proceedings considering the procedural lapse in delivering the judgement.

Normally a company aggrieved by an NCLT order would challenge

it in the appellate tribunal the NCLAT and then the Supreme Court, but Singh

had managed to contest and win in the High Court. The company was again out of

insolvency proceedings.

In between, there were some NCLT orders approving insolvency

proceedings in case of the company's subsidiaries on the petitions of some

employees for dues not paid (like the latest one) and an IRP was also appointed,

however, Singh again moved swiftly and as provided under the IBC he entered into

a settlement with the petitioners after which the NCLT then withdrew the

insolvency proceedings.

While the petitions of several former employees to recover

their dues were still pending before the NCLT, in early 2020 the COVID-19

pandemic hit the world and as is known the country went under lockdown.

In March 2020 the Central government issued a notification

under which it increased the minimum amount of default for initiating

insolvency proceedings in NCLT from Rs 1 lakh to Rs 1 crore.

So effectively all who had their dues below Rs 1 crore could

not approach the NCLT, the status quo on that remains to date. Former

employees and other creditors who had a lower demand amount for dues will not

be able to take any recourse in NCLT for the time being.

Meanwhile, RIL struggling to remain afloat had to deal with

its creditors the bond-holders in the United States, its subsidiaries had

presence in several states.

On September 02, 2020 Supreme Court of The State of New

York passed an order in favour of bond-holders for an amount of US $ 183

million against the company and six of its international subsidiaries.

In order to get this judgement stayed on a technical ground

the subsidiaries filed voluntary Chapter 11 proceedings in the United States

Bankruptcy Court for the Northern District of Alabama on October 29, 2020.

This chapter of the US Bankruptcy Code provides for a proposed

plan of reorganization to keep its business alive and pay creditors over time.

However on January 28, 2021 the court tossed out this bid by RIL's

international subsidiaries saying, the company 'did not have a realistic

ability to effectively reorganize.'

They then went in to appeal against this dismissal on February

9, 2021. In a board meeting of RBI held on February 12, 2021, it noted that

pending the appeal, the international subsidiary companies continue to

function normally.

In the meantime, for the past two years, RIL has been repeatedly

saying in all its communications that it plans to come out of the debt trap by

'repayment and restructuring its liabilities' under a Definitive Restructuring

Services Agreement (RSA) with the 'Streamcast Group' which it signed on August

6, 2019.

The whole business with the 'Streamcast Group' as per one of

our reports (Click to read about 'Streamcast Group' its promoters, history inMalta and affairs in India) was never going to happen. The whole thing is

turning out to be one of the biggest corporate ‘Hoaxes’ pulled up by the

promoters of the so-called 'Streamcast Group' in which the distressed creditors

of RIL had pinned their hope on.

So this is by and large the chronology of events where Singh

and his companies are effectively tackling any bids of creditors trying to get

any legal avenue to recover their dues, several IRPs were appointed and then

they had to be dismissed before doing any work. So it remains to be seen if the

current insolvency proceedings are stonewalled or it goes through.

Reporter

Rommel is our Editor. He has close to three decades of experience in leading publishing houses including, Fortune India, Observer of Business & Politics, The New Indian Express etc.

View Reporter News