RBI leaves Repo Rate unchanged at 6.5% for the tenth time in a row

- EP News Service

- Oct 09, 2024

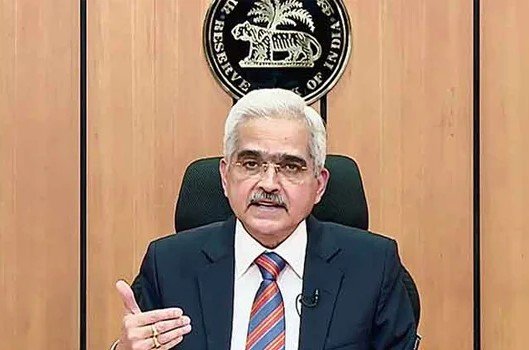

RBI Governor Shaktikanta Das

MUMBAI: The Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6.5% for the tenth consecutive time. This decision was announced during the Monetary Policy Committee (MPC) meeting held from October 7-9, 2024. However, The RBI shifted its policy stance to "neutral" from "withdrawal of accommodation," signalling a potential rate cut in the future.

Governor Shaktikanta Das highlighted that the decision to maintain the repo rate was supported by a majority vote of 5 out of 6 MPC members. The central bank's move aims to balance growth and inflation effectively, with the GDP growth forecast remaining unchanged at 7.2% for the current fiscal year. The RBI has maintained the status quo on benchmark interest rates since February 2023.

Das said RBI will remain watchful of elevated food inflation even when India's GDP growth remains strong. He emphasized the RBI's commitment to safeguarding the financial system against emerging challenges while ensuring that the economy continues on a growth trajectory.

The central bank has kept the Sustainable Deposit Facility (SDF) rate at 6.25% and the Marginal Standing Facility (MSF) rate and Bank Rate at 6.75%.

This was the first meeting of the reconstituted MPC. The three newly appointed external members are Ram Singh, Saugata Bhattacharya and Nagesh Kumar. The MPC was reconstituted by the government last month.

The unchanged repo rate is expected to have significant implications for various sectors of the economy. It will help maintain lower borrowing costs for consumers and businesses, particularly in the housing and automotive sectors, where interest rates on loans have been a critical factor in consumer spending.

GDP growth for the fiscal year 2025 projected at 7.2% looks like an optimistic outlook tempered by the need for vigilance regarding inflation, which remains a critical concern for policymakers.

Economists and analysts have welcomed the RBI's cautious approach, noting that it reflects the central bank's commitment to maintaining economic stability while being open to future rate adjustments based on evolving economic conditions and a cautious approach to future monetary policy adjustments, indicating that the central bank is closely monitoring economic indicators before making any further changes.

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News