A first in 5 years; Reserve Bank of India cuts repo rate by 25 basis points to 6.25 per centage

- EP News Service

- Feb 07, 2025

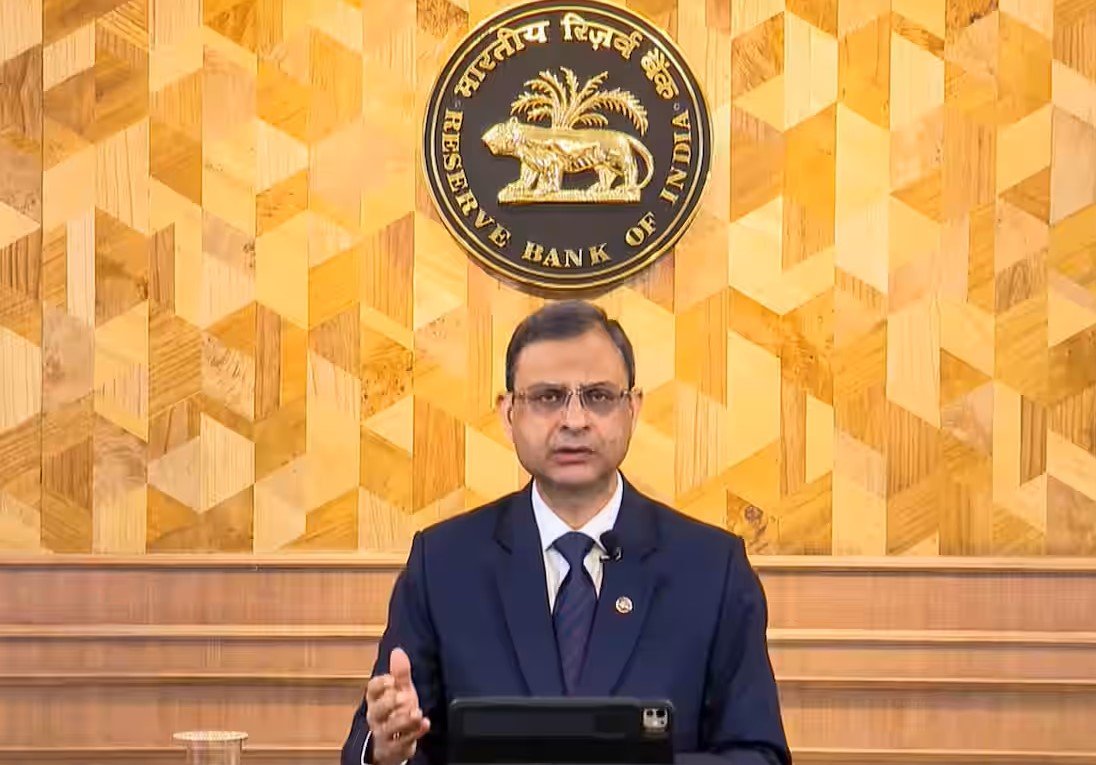

RBI Governor, Sanjay Malhotra

MUMBAI: The Reserve Bank of India (RBI) has announced a 25 basis point cut in the repo rate, bringing it down to 6.25%. This marks the first rate cut since May 2020 and is aimed at stimulating economic activity by making borrowing cheaper.

The RBI’s decision comes against the backdrop of a slowing global economy, trade tensions, and subdued domestic demand. Inflation in India has remained within the RBI’s target range of 2-6%, providing room for monetary easing. Recent data indicates that core inflation, excluding food and fuel, has been muted, reflecting weak consumer demand.

The decision was made during the RBI’s Monetary Policy Committee (MPC) meeting, which was the first under the new Governor, Sanjay Malhotra. The MPC unanimously decided to lower the repo rate to encourage spending and investment. The central bank also maintained its “neutral” stance, providing flexibility to respond to the evolving macroeconomic environment.

RBI Governor Malhotra highlighted that the rate cut is expected to benefit borrowers across various sectors, including personal loans, home loans, and MSME loans.

Banks are anticipated to pass on the benefits of the rate cut to customers, resulting in lower interest rates on loans. The RBI projects GDP growth at 6.7% for the fiscal year 2025-26, reflecting optimism about the economy’s recovery. The central bank also revised its inflation forecast, projecting CPI inflation for FY26 at 4.2%.

The rate cut has been welcomed by industry experts and economists, who believe it will provide a much-needed boost to the economy. Lower interest rates are expected to increase consumer spending and investment, driving economic growth.

However, some economic analysts are expressing caution that the impact of the rate cut may take some time to materialize, as banks need to adjust their lending rates accordingly. But largely, many have welcomed the move, as the RBI’s decision comes amid global economic uncertainties, including trade tensions and geopolitical risks being faced by all.

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News