Rate cut may not be imminent; Inflation a concern: RBI Governor

- EP News Service

- Nov 07, 2024

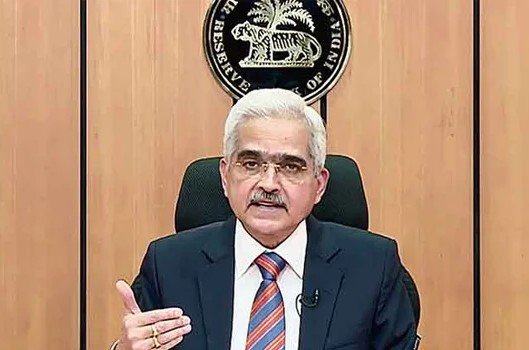

Reserve Bank of India's Governor Shaktikanta Das

MUMBAI: The Governor of the Reserve Bank of India (RBI), Shaktikanta Das, expressed cautious optimism about India’s economic trajectory but underscored persistent concerns over inflation, emphasizing that the recent shift to a neutral monetary policy stance does not signal an imminent rate cut.

Speaking at Business Standard’s annual BFSI event on Wednesday, November 6, Das addressed key economic concerns and the central bank's policy stance. While acknowledging improvements in major economic indicators, he clarified that an interest rate cut is not currently on the horizon, as inflation remains a significant concern.

Governor Das highlighted that while inflation is under control, considerable risks remain, including adverse weather conditions, geopolitical conflicts, and fluctuations in commodity prices. He also noted that October's inflation figures are expected to be higher than September's 5.5%.

The RBI kept rates steady for the 10th consecutive meeting, pointing to inflationary pressures, especially from rising food costs. Consumer inflation rose from 3.65% in August to 5.49% in September, driven by soaring food prices, which pose significant risks to price stability.

The central bank has been carefully balancing efforts to stimulate growth with the need to maintain price stability. At the October policy meeting, Das noted, "We remain vigilant on inflationary pressures. The trajectory of inflation, particularly in food and energy prices, poses risks that need to be closely monitored."

The RBI's next Monetary Policy Committee (MPC) meeting is scheduled for December 4-6, 2024, followed by another meeting on February 5-7, 2025. The central bank will continue to monitor economic conditions closely before making any decisions on interest rates.

India’s inflation has remained relatively stable in recent months, but global uncertainties—including fluctuating oil prices and geopolitical tensions—continue to create volatility. The RBI’s stance reflects a commitment to ensuring long-term financial stability rather than adopting premature measures that could undermine progress.

Economists interpret the RBI’s message as a strategic move to anchor market expectations. “The central bank’s cautious approach indicates that they are unwilling to compromise on inflation control, despite favorable growth indicators,” commented Anjali Verma, an economist at a leading financial firm.

The RBI’s current policy rate has been held steady for consecutive reviews, fostering an environment conducive to economic growth while closely monitoring inflation trends. Analysts believe this prudent strategy aligns with the global trend among central banks prioritizing inflation management amid unpredictable economic shifts. As the next policy meeting approaches, all eyes remain on evolving data and the central bank’s measured response to the twin challenges of growth and inflation.

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News