Sensex soars to lifetime high, scales 55,000

- EP News Service

- Aug 13, 2021

MUMBAI: Continuing their upward surge, the benchmark stock exchange indices, BSE Sensex and the NSE Nifty today scaled their lifetime high levels. On the closing bell on Friday, the Sensex was up by 593 points, or 1.08 per cent, to close at a historic 55,437. The Nifty index also rose by 164 points, or 1.01 per cent, to end the week at 16,529.

It has taken the Sensex just about 7 months to leap from the 50,000 mark which it had scaled on January 21, 2021, in intraday trades to cross the milestone of 55,000 while in the current year 2021 it has gained a whopping 7,700 points since it first hit the 45,000 mark on December 4, 2020, as the first wave of COVID-19 pandemic began to cool off.

Today's trading session was led by gains in the IT counters especially TCS which recorded the biggest gain in the index of 3.22% and Infosys up by 1.30% followed by L&T which gained 2.78%, Bharati Airtel and HCL Tech which were up by 2.21% and 2.06% respectively.

Some of the laggards were of PowerGrid down by 1.28%, IndusInd Bank down by 1.09%, Dr Reddy's down by 1.21%, IndusInd Bank down by 1.09%, and Bajaj Finance which ended the day with a loss of 0.74%.

Market experts attribute this stupendous rise in indices to several domestic as well as global factors, like revival across industry segments, nationwide vaccination and expectation of better earning seasons in the next few quarters.

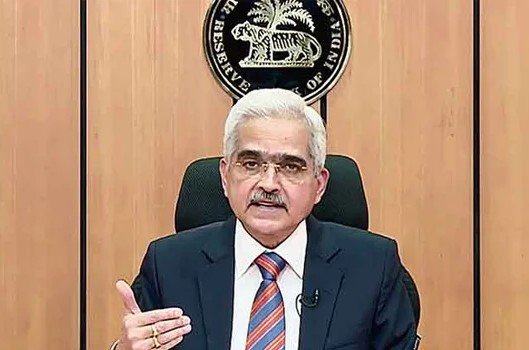

Investors have also taken the continued support by the Reserve Bank of India very positively since it signals the government's intention of giving a helping hand to the industry to support growth.

According to market analyst Nitin Jain, softening inflation which has eased to 5.59 per cent in July from 6.26 per cent in June and increased industrial production which was up by 13.6 per cent YoY in June has also fueled the sentiments.

"A highly buoyant primary market where all IPOs are getting high retail participation also signals the high interest of investors in the markets. This will further boost sentiments and I think markets can comfortably see a rise of another 10% on the indices."

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News