RBI keeps repo rate unchanged at 6.5%, says Paytm was persistent non-compliant

- EP News Service

- Feb 08, 2024

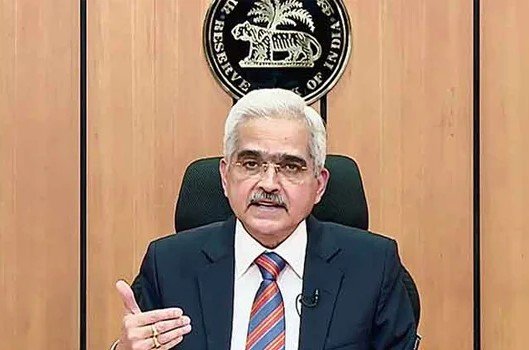

The Reserve Bank of India’s governor Shaktikanta Das

MUMBAI: The Reserve Bank of India’s Monetary Policy Committee has decided to keep the policy repo rate unchanged at 6.5%. The repo rates (the rate of interest at which banks draw funds from RBI to overcome short-term liquidity mismatches) were kept on hold for the sixth successive time in line with expectations but the element of surprise to the markets was the RBI projecting 7% growth for 2024-25 as against 6.7% earlier.

RBI governor Shaktikanta Das said the six-member committee voted by 5:1 majority to keep the repo rate unchanged in its last meeting of FY24 as retail inflation continues to be above its target of 4%, and added that the transmission of the 250-basis-point increase in the policy rate between May 2022 and Feb 2023 was not complete.

Das reiterated what he has been saying that the battle against inflation was not yet over and the last mile of disinflation was always the most challenging he said adding that RBI would persist in maintaining a scarcity of money to control prices.

On the GDP Das said the real growth for FY25 is projected to be 7%, with Q1 at 7.2% compared to the earlier projection of 6.7% and Q2 is forecasted to be 6.8%, an increase from the previous estimate of 6.5% made in Dec, while Q3 is anticipated to be 7%, up from 6.4%. Q4 is expected to reach 6.9%.

While half of bank loans, including home loans, are linked to the repo rate, the other half are linked to the cost of deposits or are fixed and yet to fully reflect the market rates. RBI projected 4.5% inflation for FY25, and trimmed price forecasts for the first and third quarters of the next financial year.

When asked about the Paytm issue, RBI Governor Shaktikanta Das said RBI's action against Paytm was taken due to ‘persisted non-compliance’ and added that the central bank has been engaged with Paytm for quite some time and all the regulatory actions are in the best interest of systemic stability and customers.

Das said, "We give sufficient time to every entity to comply and sometimes more than sufficient time to the entities for compliance. If they would comply, why would a regulator like us would have to take action?"

Reporter

Crisp, and to the point news coverage from India and around the world.

View Reporter News